Georgetown Law Extends LL.M. Tuition Discount for Former Federal Attorneys

December 15, 2025

Georgetown Law will offer a 30% reduction in tuition for Masters of Laws (LL.M.) degrees for U.S.-educated attorneys whose U.S. government jobs were affected by recent federal workforce reductions and reorganizations. The Law Center first made tuition discounts available last spring to applicants for LL.M. degree programs in the 2025-6 academic year; the new discount is available for applicants to programs starting in the fall of 2026.

“Georgetown Law has from its founding welcomed public servants as students, and we are glad to be able to help former federal workers who have experienced career disruptions gain skills for their next stage,” said Interim Dean Joshua C. Teitelbaum.

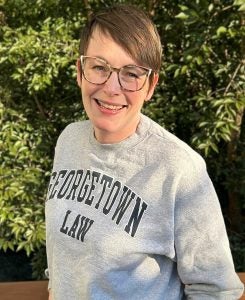

Some 25 former federal attorneys are benefiting from a tuition discount in the current academic year. We spoke with one of them, Lindsy Miles-Hare, L’26, a former Department of Education employee who is now earning an LL.M. in Taxation, about her experience.

Lindsy Miles-Hare, L’26, former Department of Education attorney and current Taxation LL.M. student

Q: What was the job you held in the federal government?

A: I served for three years in the Office of the General Counsel at the U.S. Department of Education, focusing on statutory and regulatory compliance, rulemaking, and grant administration for programs supporting English learners and Native American students and educators. In short, I helped use congressional appropriations legally and effectively, ensuring grants reached the communities they were designed to serve. Before joining the Department, I worked for more than a decade in nonprofit legal services.

I grew up in a low-income family and moved through every stage of my education with support from government programs and student loans, from Head Start preschool to a law school that offered me a full scholarship. The little girl who once counted on breakfast in her Head Start classroom grew up to meet with the Secretary of Education and give advice on how to expand opportunities for other children. That is the power of public investment in education. I hoped to retire from the Department.

Q: How did you find out about the opportunity for a tuition discount at Georgetown Law?

A: I think it was a LinkedIn post, and it sounded almost too good to be true. Because I haven’t had the chance to go to school without also working since early high school, it felt like the stars had finally aligned for me to try education the “right” way. I’m genuinely grateful for the opportunity.

Q: Had you considered studying tax law – or doing any kind of LL.M. – previously? How did you decide on tax for your specialty?

A: No, I hadn’t. Tax was an easy choice for three reasons. First, during the pandemic, I took a few MBA classes on a whim and surprised myself by enjoying subjects I once found boring or intimidating. Second, working at the Department of Education showed me how much I like living in the world of statutes and codes. Third, the employment prospects for tax attorneys, especially Georgetown graduates, made the LL.M. seem like a smart investment. I’ve been fired once in my career, from the Department of Education, and I do not recommend the experience.

Q: What has it been like going back to school?

A: Not unlike starting a new job, both invigorating and a little intimidating. The best part has been the professors. It’s clear, even in how they handle simple administrative tasks like organizing their online curriculum pages, that they love what they do and genuinely want us to succeed. They mix technical instruction with anecdotes from practice, and they share their contact information so we can stay in touch about our careers. They are the program’s greatest strength.

Q: What kind of work do you want to do next?

That is a tough question, because there’s what you want to do and what someone will hire you to do. I’m drawn to the practical side of tax law. That could mean helping businesses with tax planning so they can reinvest instead of overspending, working for the IRS to ensure taxpayers pay their fair share or leveraging my background to advise charitable organizations. And if a reality TV star came to me and said, “I want to use my winnings from ‘Naked Escape From Spider Island’ to solve the next Flint water crisis,” who wouldn’t want to help make that happen?

Q: Any advice for fellow former Feds considering whether to apply to the tax program – or any LL.M. program – for next year?

A: If someone is considering applying, they probably should. If they’re unsure, they should talk to the advisor for the program they’re looking at. It’s easy to connect with someone, and Ellis [Graduate Tax Program Director Ellis Duncan] was incredibly helpful when I didn’t know where to start.

I also tell people that the program lasts only one year, which is nothing in the span of a career, and there’s no way to replicate the depth and breadth of what you learn.

Georgetown Law is currently accepting applications for LL.M. programs for the coming academic year. Applications must be completed by July 1, 2026 at the latest to be considered for a Fall 2026 start (before June 1 is recommended). Applicants through this program for affected federal workers may request an application fee waiver, and should apply through the direct application form rather than applying through LSAC. Application requirements, including the list of required documents, can be found here. The LL.M. tuition discount is one of several resources and opportunities Georgetown University is offering to affected federal workers.